How to Start a Blog in 2024: Ultimate Guide for Beginners

If you've ever wondered how to start a blog, you're in the right place.

I've been a full-time blogger since 2011, and have taught thousands of bloggers over the years how to get started.

To begin, this guide will provide an in-depth overview of the eight steps necessary to launch your blog.

First, we'll help you choose a niche by identifying your passion and researching potential markets while analyzing the competition.

Next, we'll discuss selecting an appropriate blog domain name and hosting provider for your blogging platform.

Moving on, we will cover designing your blog with themes or templates and customizing its design elements along with installing plugins and widgets.

After that, our focus shifts towards creating quality content for your blog which includes writing engaging posts and pages optimized for SEO while promoting them on social media platforms.

Finally, learn how to monetize your blog through affiliate marketing strategies, displaying ads on your site, and selling digital products.

By following these steps outlined in our "How to Start a Blog" guide, you can begin building a successful online blog today.

Table of Contents (click to expand)

- Step 1. Choose Your Blog's Niche

- Your Blog Success Depends on 3 Factors

- Identify Your Target Audience

- The GPS Audience System

- Tips to Select an Engaging and Profitable Niche

- How do I stand out from the competition?

- How do I know if my blog niche is too big or too small?

- Step 2. Keyword Research for Effective Content Creation

- Step 3. Pick the Right Platform and Hosting Service

- Comparing Popular Blogging Platforms: WordPress vs Ghost

- Which tools do I need to get started?

- Tools to Discover Your Blog Niche

- Tools to Start a Blog

- Step 4. Create Engaging Content Consistently

- Schedule Regular Posting Times Throughout the Week

- Use Opening Questions or Relevant Quotes from Recognizable Authorities

- Step 5. Ensure Quality Writing with Editing Tools

- Utilize Editing Software such as Grammarly or Hemingway Editor

- Proofreading Tips from Professional Writers

- Step 6. Collaboration Strategies For Blog Growth

- Identifying Potential Collaborators Within Your Niche

- Tips for Successful Collaborations and Guest Posting

- Step 7. Monetize Your Blogging Efforts

- Blog Income Model #1: Writing Income Streams

- Blog Income Model #2: Teaching Income Streams

- Blog Income Model #3: Speaking Income Streams

- Blog Income Model #4: Coaching Income Streams

- Blog Income Model #5: Affiliate Marketing Income Streams

- Blog Income Model #6: Run Ads on Your Blog

- Step 8. Enhance Blog Promotion and SEO Techniques

- On-Page Optimization Techniques

- Off-Page Promotion Methods

- FAQs in Relation to How to Start a Blog

- How to Start a Blog: A Step-by-Step Guide

- How to Start Writing a Blog for Beginners

- How to Start a Blog with No Experience

- Final Thoughts

Step 1. Choose Your Blog's Niche

To start a successful blog, it's essential to have a clear understanding of your target audience and choose a highly specific topic that serves their needs.

New bloggers often struggle with trying to niche down their audience, but it's one of the best ways to build your blog fast.

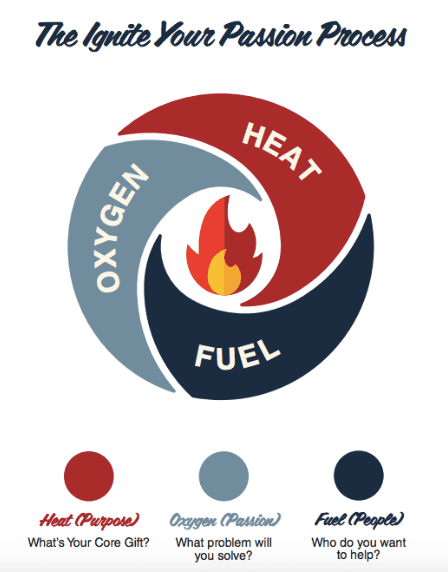

Nailing down the right blog niche comes down to getting just three things right. Building a thriving online business is similar to starting a fire. For that, you need three elements: heat, fuel, and oxygen.

But what does starting a fire have to do with starting a business? Well, let’s take a closer look.

- Heat: Represents your purpose or calling

- Fuel: Represents your passions

- Oxygen: Represents the people you want to help

When all three of the above are there, you have a profitable online business model (see image below).

Your Blog’s Success Depends on 3 Factors

- Factor 1: Purpose–What’s your unique ability? You should begin your search by looking inward first. What’s your unique ability? Where do you show up best? Are you a writer? Are you better at speaking? Do you thrive best in coaching situations? Uncovering your core gift is the best place to start.

- Factor 2: Passion–What can you best help with? What problem are you passionate about solving? Which topics do you love to learn about? Which topics make you mad, angry, or frustrated? Find a passion you can attach yourself to for the next two to five years.

- Factor 3: People–Who do you most want to serve? It’s one thing to be gifted; it’s another to make sure the gift is useful. It’s great to be passionate, but does anyone else share in that passion? Attaching your abilities and passions to serving a group of people is what makes your business combustible. It ignites the spark, that fuels the flame. All three must exist to have a profitable online business.

Identify Your Target Audience

Determine your target audience before beginning to blog so that you can create content that resonates with them.

Knowing who you're writing for will make it easier to brainstorm blog topics that resonate with them and keep them coming back for more.

Maybe you are wondering, “Who ARE those people I want to serve in the first place?” In our Discover Your Blog Niche Course, we go in-depth on this topic, but let me share the highlights with you.

The GPS Audience System

Every day millions of people rely on a GPS device to help guide them while they are driving or walking. But did you know that people have a built-in GPS?

The GPS Audience System is a simple, yet powerful acronym. GPS stands for goals, passions, and struggles. Your best chance of success is to find an audience’s goals, passions and struggles that you want to serve.

Let’s take a closer look:

- Goals: Whose goals are you the most qualified to help? Maybe they are goals you’ve personally accomplished and now you want to help others. Also, are people already consuming blogs, podcasts, and videos on this topic? Before you blaze a new trail, we want to find proof online that people care about this topic.

- Passions: Is the audience you want to serve just a fad or is it evergreen? Some passions are just fleeting, while other passions have a proven track record. Only pursue an audience that has demonstrated five years or more of consistent demand.

- Struggles: This is where the gold is. Are people spending money on this topic to overcome their struggles? As an influencer, there’s a great gain to be had in helping others overcome challenges.

Tips to Select an Engaging and Profitable Niche

Picking a blog's niche and building an audience can feel overwhelming if you're not sure how to start a blog.

Here are a few other considerations when selecting a profitable blog niche:

- Personal Interests: Choose something you're passionate about or knowledgeable in - whether it's travel, cooking, fashion, or personal development.

- Demand: Look at popular blogs within the industry and identify any gaps in the market that could be filled by providing unique insights on particular subjects.

- Potential Earnings: Consider how easy it would be to monetize this niche through affiliate marketing partnerships or selling digital products such as e-books or online courses.

A well-chosen niche is key when you begin blogging; not only does it give direction, but also helps ensure long-term success as readers continue returning due to the relevance and value offered to them throughout the years spent following along.

A good blog lives to deliver value to a specific audience. Whether it is a recipe blog, travel blog, career blog, or parenting blog. A blog's niche is important so don't rush this process.

How do I stand out from the competition?

A common question I get is: “Jonathan, there’s just so much competition out there. How do I stand out among all of the noise?”

Let me share with you two of the most powerful principles I have learned.

1. The more authentic you are, the more you stand out.

When I first began in the online business space, I was a copycat. Secretly fearing that I had nothing of value to offer, I tried to be like other influencers. After all, if they were successful, it must be a style that works.

I became a bad version of their style. The best way to stand out is to embrace your authentic self. The more authentic you are, the more you stand out.

Others can’t simply copy you.

Decide to become a more genuine version of yourself.

2. Be a big fish in a little pond.

If you are struggling with how to stand out from the competition, maybe your market is too big. When I started my first blog, I labeled myself as a “life and career coach.”

I didn’t want to narrow my audience.

The problem was I was facing too much competition. I was one tiny fish in the big, scary ocean.

Realizing my mistake three months later, I niched down to being a career coach for accounting and finance professionals.

My competition shrunk overnight.

There were not as many career coaches focused on just accounting and finance professionals. I became the big fish in a little pond.

How do I know if my blog niche is too big or too small?

Once you learn how to start a blog, you'll want to be sure to pick a niche that is just the right size.

How do we find the sweet spot of being in a niche that is not too big or too small? Fortunately, there are some online tools that can help us answer this important question.

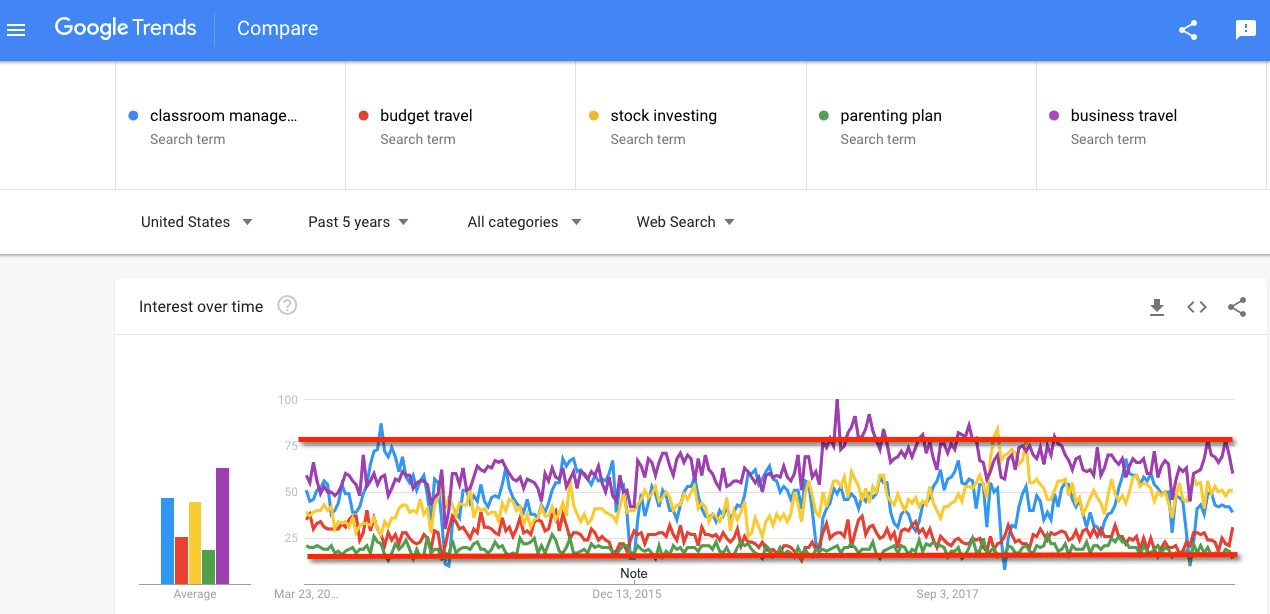

One of my favorite tools to measure niche size is Google Trends. With Google Trends, you are able to compare market sizes across different niches. The goal is to find niches where other people have been successful and then find a niche you want to serve with a similar demand.

Stay away from topics with too much demand like “fitness.” Also, steer clear from topics with not enough demand like “kettlebell fitness.” Below you will find an example of five blog niches that all hit the sweet spot.

Step 2. Keyword Research for Effective Content Creation

Once you know how to start a blog, the real work begins - you'll need to consistently create high-quality blog content and engage with your readers to grow your blog over time.

In order to create engaging blog content that resonates with both search engines like Google and potential readers alike, invest time conducting keyword research before you begin writing.

This will help you identify popular search terms within your chosen niche, as well as uncover less competitive keywords that can still drive traffic to your blog.

Tools such as Ahrefs, Moz Keyword Explorer, or even Google's own Keyword Planner are great resources for this task.

By utilizing these terms in the titles and ideas of your blog posts, you can increase the chance of appearing higher on search engine results pages (SERPs) and getting more visitors to your site.

With a defined audience, niche, and keyword research, create engaging content that meets readers' needs and enhances online visibility with SEO strategies.

Finding the ideal specialism for your blog is a crucial part of guaranteeing that you create content that appeals to your desired readers.

By researching keywords and evaluating web hosting services, you can make sure to pick a platform and service that fits all of your needs.

Another helpful tip is that most successful bloggers use a blog template. This can speed up the blog content creation process. Remember, a blog gains traction through consistent publishing.

Step 3. Pick the Right Platform and Hosting Service

One of the most important decisions, when you are learning how to start a blog, is picking the right blogging software and web hosting provider.

When selecting the right platform for creating your blog, WordPress is often recommended due to its user-friendly interface and customizable design options.

However, there are other popular blogging platforms like Ghost which suit your needs better. To make an informed decision, let's compare these two popular choices along with their features.

Comparing Popular Blogging Platforms: WordPress vs Blogger

- User-friendliness: Both WordPress and Ghost offer easy-to-use interfaces suitable for beginners and experienced bloggers. A WordPress blog provides a wider range of customization choices, from plugins to themes.

- Design flexibility: WordPress offers greater design flexibility with thousands of free and premium themes available on the market. Ghost has a more limited selection of templates.

- Ecosystem & Community: WordPress boasts a vast ecosystem and community, with a wealth of resources such as tutorials, forums, plugins, and themes. Ghost has a smaller community with fewer resources available for support and expansion.

- Maintenance & Security: Self-hosted WordPress blog (WordPress.org) requires you to take care of security updates yourself, but it gives you full control over your site data. Ghost takes care of maintenance and security for you, but it means giving up ownership rights over your content since it's hosted on their platform.

In general terms, WordPress is considered superior in terms of customization capabilities. However, Ghost is the better option for the beginner blogger.

If your goals include creating digital products like online courses, membership sites, or even coaching programs, then be sure to check out Systeme.io and Kajabi.com.

They are both blogging platforms that also have built-in marketing funnels, course hosting, and more.

Kajabi is my favorite but is more than a blogging platform. It is an all-in-one tool that allows you to create landing pages, sales pages, host courses, sell coaching programs, and more.

Systeme.io is a blogging software that allows you to start a blog for free. While the free version does have some limitations, the blogging platform itself gives you everything you need to make money blogging.

Choosing the right blogging platform and blog hosting service is essential to ensure your blog runs smoothly. Producing appealing content regularly can aid in constructing a following that will elevate your blog.

On last tip before we move on. Be careful not to spend too much time on the blog design or even blog theme. It can be a form of procrastination.

While blog design can be fun when expressing your style and personality, the best way to build your blog online is by writing content consistently.

Which tools do I need to get started?

The good news is the tools available today for bloggers are way better than the options I had when I began. Below you’ll find a list of both free and paid tools listed under two categories: discovering your blog niche and launching your blog.

Tools to Discover Your Blog Niche

- Google for research: Free research on your topic anytime you need it.

- Self-assessments: Personality tests and assessments can help us learn more about our strengths.

- Amazon research: Use Amazon as a way to discover if people are making purchases and leaving reviews on your topic.

- Google Trends: A great free tool to help you determine the demand of any niche.

- Blog research: Search for other blogs in your niche as a source of ideas

- Podcast research: Are there other podcasts in your niche and what topics are they covering?

- YouTube research: Search for YouTube channels in your niche to see if people are subscribing.

- Udemy research: Are people buying courses already on your topic?

Tools to Start a Blog

- NameCheap for a domain: My recommended tool for registering your domain.

- HostGator for web hosting: A great website host when you are first getting started.

- ConvertKit for email marketing: My preferred email marketing tool

- Kajabi for creating and selling online products: This is my go-to software for hosting all of my online courses and membership site.

- Veed.io for YouTube videos. It makes video creation and editing easy.

Step 4. Create Engaging Content Consistently

As you begin blogging, remember that consistency is key. The best way to be consistent is to have lots of blog post ideas.

For most beginner bloggers, one new blog post a week is fine. However, keep in mind that in order to build a blog following, you'll eventually need to produce hundreds of blog articles.

In that case, aim for at least three to four new posts per week to maintain reader engagement.

Focus on headline writing as well as captivating introductions using various techniques.

Schedule Regular Posting Times Throughout the Week

To ensure a consistent flow of fresh content, it's essential to create a posting schedule that works best for both you and your readers.

A regular posting cadence not only helps keep your audience engaged but also signals search engines like Google that your blog is active and worth indexing.

Consider these tips when creating a posting schedule:

- Analyze peak traffic times on your website using tools like Google Analytics.

- Create an editorial calendar outlining topics and deadlines ahead of time.

- Set aside dedicated time each day or week specifically for drafting, editing, and publishing content.

Note: If you are overwhelmed with the idea of multiple blog posts per week, consider using an AI blog post writing tool like ContentAtScale.ai. Give them a keyword and they will produce a long-form content draft for you to help you get started!

Use Opening Questions or Relevant Quotes from Recognizable Authorities

The introduction of each blog post plays a crucial role in capturing the attention of readers.

To make sure they continue reading through the entire article, try incorporating one or more of these proven techniques:

- Pose an engaging question: Start with a thought-provoking question related to the topic at hand. This encourages readers to think about their own experiences while setting up expectations for what's coming next in the post.

- Incorporate relevant quotes: Including insightful quotes from industry experts can add credibility to your argument while piquing the interest of readers. Be sure to properly attribute and link back to the blog content where you found the quote.

- Share a personal anecdote: Opening with a relatable story from your own life can help humanize your writing, making it more engaging for readers who might be going through similar experiences or challenges.

In addition to these techniques, always ensure that your blog post titles are clear, concise, and accurately reflect the content within. A good blog title can increase the number of clicks you get with search engine users.

This not only helps with reader engagement but also improves search engine optimization (SEO) efforts by signaling what each article is about.

For more tips on crafting compelling headlines, check out this comprehensive guide on headline formulas that work.

Creating engaging content consistently is an essential part of any successful blog.

To ensure quality writing, consider utilizing editing tools such as Grammarly or Hemingway Editor for proofreading and tips from professional writers.

Step 5. Ensure Quality Writing with Editing Tools

In addition to producing high-quality written content, it's essential to use editing tools like Grammarly or Hemingway Editor to catch any mistakes before publishing articles online.

This will ensure professionalism and credibility within your field of expertise.

Utilize Editing Software such as Grammarly or Hemingway Editor

Grammarly: A popular choice among bloggers, this AI-powered writing assistant not only checks for grammatical errors but also provides suggestions on improving clarity, engagement, and delivery. This AI-powered assistant comes with a plagiarism detector that guarantees your blog posts are unique.

Hemingway Editor: Another excellent tool for writers is the Hemingway Editor. This web-based application helps you improve readability by highlighting lengthy sentences, passive voice usage, adverbs, and complex phrases - making it easier for you to create concise yet engaging content.

Proofreading Tips from Professional Writers

- Give yourself some time: After finishing a draft of your blog post, take a break before proofreading it. Stepping away from the text allows you to come back with fresh eyes.

- Focus on one issue at a time: When revisiting your work during the editing process focus on specific issues first (e.g., grammar), then move onto other aspects like sentence structure or word choice.

- Reread aloud: Reading your content out loud can help identify awkward phrasing or unclear sentences that may have been missed during the initial writing process.

- Use a checklist: Create a blog post checklist to ensure you've covered all essential elements, such as SEO keywords, engaging headlines, and proper formatting. This will help maintain consistency across your entire blog.

By implementing these editing tools and proofreading tips into your blogging routine, you'll be able to produce polished content that resonates with readers while also boosting your credibility within the blogging community.

Using an editing tool to ensure quality writing is essential for any professional writer. It's time to investigate how teaming up can assist in broadening the reach of your blog and facilitating its growth.

Step 6. Collaboration Strategies For Blog Growth

Collaboration plays a significant role in how a blog grows.

Seeking out respected members within your industry, partnering with them on projects, and mentioning each other's work across various channels helps build brand awareness and reach a wider demographic of potential followers and customers.

Seek out other influencers in your niche, partner with them on projects, and mention each other's work via email or social media posts.

In this section, we'll explore how top bloggers form partnerships that help their blogs grow.

Identifying Potential Collaborators Within Your Niche

The first step to successful collaboration is identifying potential partners who share similar interests or expertise within your niche. You can find these individuals by:

- Browsing popular blogs or websites related to your topic

- Searching for influencers on social media platforms like Twitter, Instagram, or LinkedIn

- Joining relevant online communities such as Facebook groups or Reddit forums where discussions about your niche take place

- Attending industry events or conferences where you can network with others in person

BuzzSumo, an influencer search tool, is another excellent resource for finding collaborators based on their content performance metrics.

Tips for Successful Collaborations and Guest Posting

To ensure fruitful collaborations with fellow bloggers and writers from the blogging community, consider following these tips:

- Pitch value-added ideas: When reaching out to potential collaborators, present unique ideas that complement their existing content while providing additional value to their audience.

- Create high-quality content: Craft posts that are comprehensive, captivating, and educational. This will make a positive impression on your partner as well as their readers. This will not only impress your host but also help you establish credibility with their audience.

- Adhere to the host's guidelines: Before submitting a guest post or collaborating on a project, make sure to follow any specific guidelines provided by the host. This includes adhering to word count limits, formatting requirements, and submission deadlines.

- Promote shared content: After publishing collaborative work or guest posts on another blog, share it across your own social media channels and encourage your followers to engage with it. This helps increase visibility for both parties involved in the collaboration.

In addition to these tips, consider using tools like Trello or Asana for organizing joint projects and keeping track of progress throughout the blogging journey.

Collaborative tactics are key to improving blog success and can be a great tool for forming connections with other bloggers in your area of expertise.

Monetizing your blogging efforts is the next step, as it allows you to generate income from your content while still providing value to readers.

Step 7. Monetize Your Blogging Efforts

Starting a blog can be a great way to earn money online, but it's important to learn how to start a blog that's monetizable.

Once you start blogging, it's essential to explore various monetization strategies that can help you maximize revenue from your blog.

This includes selling digital or physical products related to your niche, affiliate marketing opportunities with relevant brands and companies, and even investing in paid ads.

By consistently implementing these methods effectively, you'll be well on your way to making a full-time living solely through blogging activities.

Here are a few of my favorite ways to make money blogging.

One of the most profitable online business models today is the information business. There are huge profit margins (with few hard costs) with digital products.

Online courses, monthly membership sites, and group coaching programs all have leverage and scale uniquely built-in.

Below are a few ideas to get you started:

Blog Income Model #1: Writing Income Streams

Have a passion for writing? It’s never been easier than it is today to earn money writing.

- Kindle Books – No need to wait for approval from a publisher. Write that book and list it for sale in Amazon’s Kindle store for free.

- Physical Books – Want a physical book? You can use a site like Amazon Direct Publishing to list an actual physical edition of your book for sale on Amazon.

- Audiobooks – If you have a decent microphone, you can convert your book into an audiobook. It will get listed for sale on Amazon right next to your Kindle book and physical book.

Note: I did all three of the above in just six months with my book, The 15 Success Traits of Pro Bloggers. Since 2015, I’ve received monthly royalty payments from all three income streams above.

Blog Income Model #2: Teaching Income Streams

Love to teach? Well, you can get paid to teach online. The best part is that you can do it from anywhere. Below are a few teaching models that have worked best for me:

- Online Courses – I created my first online course back in 2010. It allowed me to start making money early on my personal blog. Even with a small list at the time, I was able to generate $1455 in the first weekend. Ever since then, creating and selling online courses have been a fundamental strategy I’ve used to grow my blog business.

- Membership Site – Starting a membership site can be one of the smartest business decisions you make. Getting customers on a monthly recurring payment strategy can help sustain a business long-term. I’ve run a membership site for over six years now and I’m so glad I made the decision to start one.

- Paid Webinar Series – This was the very first income stream we created for Blogging Your Passion. The reason it’s a good income model to start with is that it’s easy to get off the ground quickly. You just need a good topic and a sales page. The content will be delivered live over 4-6 webinars.

Blog Income Model #3: Speaking Income Streams

- Keynote Talks – Want to get paid to speak? There are conferences, workshops, and association meetings that are always looking for speakers.

- Host Live Events – Why not create your own live event? People love to gather in person around a shared passion.

- In-Person Workshop – You can also create a more high-ticket workshop. I’ve charged $5000 for a 2-day workshop. The key here is to limit the number of attendees to a smaller group in order to make it more exclusive.

Blog Income Model #4: Coaching Income Streams

- 1-on-1 Coaching – This is one of the easier income streams to set up. Publish a “work with me” page on your blog and have people pay you for your time. While not scalable, it is a fast income stream to get up and running.

- 4-6 Week Group Coaching – If you desire to coach others but are worried about scaling your business, then consider a short-term group coaching experience. You can limit the time to just one hour per week, but coach six to ten people all at once.

- 1-Year Mastermind Programs – This is one of the more profitable coaching income streams. People will pay tens of thousands of dollars to join in exchange for one year of mentoring with you.

Blog Income Model #5: Affiliate Marketing Income Streams

Affiliate marketing involves partnering with brands or companies whose products/services are relevant to your blog's niche.

As an affiliate marketer:

- You promote these offerings on your site using unique tracking links provided by the company/brand.

- You earn a commission when someone purchases through one of your links.

To succeed in this space:

- Develop effective strategies for promoting affiliate offers.

- Research reputable programs within your niche, such as Amazon Associates or ShareASale.

- Disclose affiliate relationships to maintain transparency and trust with your audience.

Blog Income Model #6: Run Ads on Your Blog

Paid ads can also contribute towards monetizing your blog.

By placing display advertisements on your site through platforms like Google AdSense or Media.net, you'll earn revenue each time a visitor clicks on an ad.

To optimize this strategy:

- Place ads strategically throughout the website.

- Monitor performance regularly and make adjustments as needed.

- Bear in mind that user experience should not be compromised by excessive advertising.

However, the key to earning with paid ads is traffic volume. So, don't be discouraged if you don't make much in the beginning. It can grow over time as you publish more content.

For other ideas on how to monetize a blog, check out this post: How Do Bloggers Get Paid?

Incorporating these monetization methods into your blogging efforts will help ensure that all of the hard work you put into creating content is rewarded financially.

As you continue to grow and evolve as a blogger, remember to stay open-minded about new opportunities and strategies for making money from your passion.

By utilizing the right monetization strategies, you can maximize your blogging efforts and increase revenue.

Now let's explore how to enhance blog promotion and blog SEO techniques for maximum visibility.

Step 8. Enhance Blog Promotion and SEO Techniques

To attract more readers, it's crucial not only to focus on headline writing but also to learn how to optimize blog posts for search engines like Google.

This will ensure that the content is easily discoverable by users searching for information in your chosen niche.

In this section, we'll discuss on-page optimization techniques such as keyword placement and meta descriptions, as well as off-page promotion methods including social media sharing.

On-Page Optimization Techniques

- Keyword Placement: To improve your blog's visibility in search engine results pages (SERPs), strategically place relevant keywords throughout your content. Make sure they appear naturally within the text without overstuffing or disrupting readability. For example, include them in the title tag, headings, subheadings, and body of your post.

- Meta Descriptions: A compelling meta description can entice users to click through from SERPs to read your blog post. Write a concise summary of each article using approximately 155 characters while incorporating primary keywords related to the topic at hand. You can use tools like Portent's Meta Description Generator.

Off-Page Promotion Methods

- Social Media Sharing: Promote new blog posts across various social media platforms such as Facebook, Twitter, LinkedIn, or Pinterest where potential readers may be active members of their respective communities interested in the subject matter presented in your articles written online. Create eye-catching graphics and headlines to encourage engagement, shares, likes, and comments, ultimately driving traffic back to your website as your audience grows exponentially over time.

- Guest Posting: Reach out to other bloggers within your niche and offer to write guest posts for their websites. This not only helps build relationships with fellow content creators but also exposes your work to a new audience, driving more traffic back to your own blog. Include a link to your site in the author bio or inside the post when it's appropriate.

In addition, consider joining blogging communities like Medium.com, participating in forums related to your niche, and engaging with readers through comments on both your own blog and others'.

These activities will help establish credibility while building connections that can lead to increased visibility for future content updates as well as potential collaborations and partnerships further down the line.

Your success journey begins today!

Blog FAQs on How to Start a Blog

How to Start a Blog: A Step-by-Step Guide

If you're passionate about a topic and want to share your knowledge with others, starting a blog is a great way to do it. Here's a step-by-step guide to help you get started:

- Identify your target audience and niche. Determine who you want to write for and what topics you want to cover. This will help you create content that resonates with your readers.

- Choose a blogging software and web host. Consider using a platform like Ghost to get started.

- Design your blog layout and theme. Choose a theme that reflects your brand and customize it to fit your style.

- Craft engaging content regularly. Write high-quality blog posts that provide value to your readers and keep them coming back for more.

- Conduct keyword research and optimize for SEO. Use tools like Google Keyword Planner to find keywords that your target audience is searching for and optimize your content accordingly.

- Build brand awareness through collaborations and networking. Connect with other bloggers and brands in your niche to expand your reach and build your brand.

- Monetize your efforts with various income sources. Consider using affiliate marketing, sponsored posts, or selling digital products to make money from your blog.

How to Start Writing a Blog for Beginners

If you're new to blogging, here are some tips to help you get started:

- Choose topics that interest you. Write about things you're passionate about to keep yourself motivated.

- Practice writing consistently. Set a schedule and stick to it to develop your writing skills.

- Learn basic SEO techniques. Use keywords and meta descriptions to optimize your content for search engines.

- Engage with other bloggers and communities. Comment on other blogs and participate in online groups to build relationships and grow your audience.

- Be patient. Building an audience takes time, so don't get discouraged if you don't see results right away.

How to Start a Blog with No Experience

Even if you have no prior experience, you can still create a successful blog by following these steps:

- Learn about blogging platforms. Research different platforms and choose one that fits your needs.

- Research best practices. Read blogs like ProBlogger to learn about content creation, blog SEO, and marketing strategies.

- Connect with relevant communities. Join online groups and forums to connect with other bloggers in your niche.

- Remain consistent. Set a schedule and stick to it to build your audience over time.

What is the first thing I should do when starting a blog?

The most important first step is to choose your blog name and register your domain name. Pick a name that describes your main topic and is easy to remember. A good domain name will help with search results down the road.

What is the best free blogging platform for a first-time blogger?

WordPress.org with a free theme is the easiest way for first-time bloggers to start. WordPress is user-friendly and has lots of free themes and plugins. Other free platforms like Blogger and Wix are options too.

How do I write my first blog post?

Start by writing about a topic you know well and are passionate about. Introduce yourself and explain your unique perspective. Include visual elements like photos to engage readers. Stick to simple steps and detailed instructions to provide value.

What are some tips for starting a successful blog?

Consistently publish high-quality, useful content. Use SEO best practices like Yoast to optimize posts. Build an email list to connect with readers. Collaborate with others in your niche. Promote your content on social media. Stay focused on your main topic and audience. Patience is important - growing a blog takes time.

Final Thoughts

Starting a blog can be an exciting and rewarding experience, but it requires careful planning and execution.

By choosing the right niche, selecting a domain name and hosting provider, designing your blog, creating quality content, and monetizing your site effectively, you can establish yourself as an authority in your field while generating income.

If you're starting a blog and feeling overwhelmed by all the technical details, you might want to consider taking a course on how to start a blog. Check out our Market Your Message Academy as we have courses on how to blog for a living.

In summary, starting a successful blog involves identifying your passion and researching your niche to stand out from competitors.

You'll need to select a reliable hosting provider and design a visually appealing website that's easy to navigate.

Generating content of a superior caliber, optimized for search engine optimization (SEO), is imperative to draw visitors to your site. Finally, monetize through affiliate marketing strategies or by selling digital products.